Replacing Chinese copper supply chains requires US$85 billion for new smelting and refining

SINGAPORE/LONDON/HOUSTON/ 15 August 2024 – As major global economies look to reposition critical minerals supply chains outside China, the resulting inefficiencies could increase the cost of finished goods and delay the energy transition. The world cannot achieve decarbonisation without copper, a crucial component in electrification. Currently, China dominates copper mining, downstream processing (smelting and refining) and semi-manufacturing. According to a new report by Wood Mackenzie, demand for copper is expected to rise by 75% to 56 million tonnes (Mt) by 2050, necessitating substantial investment.

Shifting away from China will require massive investments in new copper processing and fabrication facilities. The August Horizons report, Wood Mackenzie's ‘Securing copper supply: no China, no energy transition,’ states that replacing China’s smelting and refining capability alone to meet the rest of the world's demand would require nearly US$85 billion.

“A scenario without China for the copper supply chain would require a substantial increase in processing capacity to meet energy transition targets,” said Nick Pickens, research director, global mining at Wood Mackenzie.

“Based on our projections, there will be an additional 8.6 Mt of copper demand outside China over the next decade. This demand represents 70% of smelter capability and 55% of fabricator capacity in the rest of the world. As governments and manufacturers aim to diversify away from China, it is crucial to consider the entire supply chain, not just mining operations.”

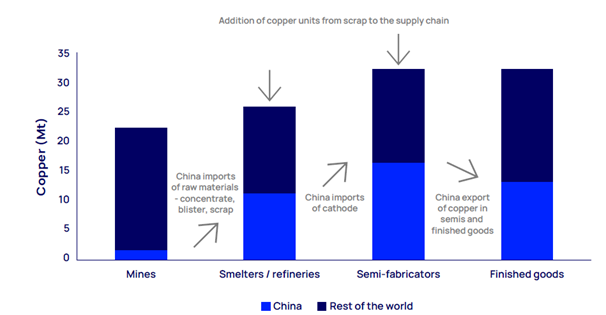

China’s role in the copper supply chain, 2023

Source: Wood Mackenzie

The global copper supply chain is a complex system comprising four key stages: mining, smelting and refining, semi-fabricating, and manufacturing of finished goods. Copper flows from raw material extraction in the Americas and Africa to downstream processing and manufacturing, predominantly in China. The country’s substantial investments in downstream processing and semi-manufacturing sectors present significant challenges to global copper supply security.

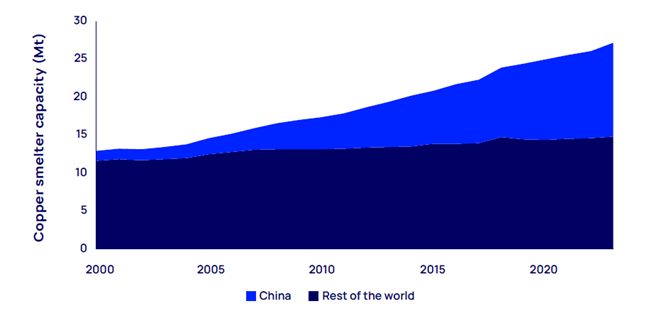

The report states that since 2000, China has accounted for 75% of global smelter capacity growth and currently controls 97% of global smelting and refining capacity, contributing over 3 Mt of production and nearly US$25 billion in investment. The country has also added nearly 11 Mt of copper and alloy capacity since 2019, representing around 80% of global additions. Approximately two-thirds of these facilities produce wire rods, giving China half of the world’s fabrication capacity, with further expansion underway.

Growth in global copper smelter capacity is dominated by China

Source: Wood Mackenzie Lens Metals & Mining*

“China's copper smelting industry has undergone significant evolution,” said Zhifei Liu, managing consultant, copper markets at Wood Mackenzie. “In the 2000s, a drive for stricter environmental and efficiency standards led to the modernisation of smelting capabilities.

“Today, Chinese smelters are low cost and meet high environmental standards, particularly in sulphur dioxide capture, making them highly competitive.”

Pickens added that semi-fabricators outside of China, especially in Europe, are facing challenges due to lower utilisation and higher operating costs. Regulations on carbon emissions, like the European Union’s Carbon Border Adjustment Mechanism, could reduce competitiveness by imposing higher taxes on the European copper industry without providing equivalent benefits. Additionally, US government incentives such as the Inflation Reduction Act may not ensure the long-term sustainability of the industry.

The report also highlights significant shifts in the global copper smelting landscape, with new facilities set to come online this year outside China. India is launching a custom smelter, Indonesia is adding two integrated smelters, and a new smelter in the Democratic Republic of the Congo is expected to be completed by 2025, primarily driven by Chinese investment. According to Wood Mackenzie, these additions will add 1.6 Mt to global smelting capacity, the largest increase outside China in decades.

However, there are no plans for new primary smelting capacities in North America or Europe. Instead, the US is focusing on the secondary market and scrap copper, including establishing its first secondary smelter for complex materials in Georgia.

“While copper supply risks can be mitigated and some rebalancing has begun in various countries, the scale of China’s dominance in the supply chain means complete replacement is unfeasible,” said Pickens. “The introduction of new processing and fabrication facilities may result in higher costs and delays in the energy transition.

“Financing these investments presents additional hurdles, with resistance to new smelter projects on environmental and social grounds particularly strong in Europe. Pragmatism and compromise will be essential to achieve net zero goals without imposing excessive costs on taxpayers. Easing global trade restrictions could be one necessary concession.”

ENDS

Editor note:

The global shift toward clean energy and decarbonisation hinges significantly on copper. With the increasing demand for copper, efforts to secure critical minerals and reduce reliance on China's supply pose challenges. Although the necessity for investing in new mines is evident, the effects on downstream processing and semi-manufacturing are frequently disregarded. Our latest Horizons report addresses these issues. You can read it here.

Wood Mackenzie Lens Metals & Mining is an integrated cross-commodity data analytics platform for key mined commodities, providing a complete picture of how markets and assets develop within the energy and natural resource value chain across Wood Mackenzie’s energy transition scenarios.

-

Shifting away from China for critical minerals would increase costs and delay the energy transition,Replacing Chinese copper supply chains requires US$85 billion for new smelting and refining SINGAPORE/LONDON/HOUSTON/ 15 August 2024 – As major gl2024-08-15

-

向“绿”向“新”丨深圳科华携超充方案亮相2024北京充换电展告别夏长,共赴一场秋实之约 相聚北京,见证充电生态未来 8月14日上午,2024北京国际充电桩及换电站展览会(CPSE)在北京首钢会展中心盛大启幕。超300家国内外生产商、运2024-08-15

-

一站式解决厨房用水问题,A.O.史密斯重塑厨房用水新标准立秋已至,气候转凉。虽然用电高峰期已过,但家庭用水的需求并未减少,特别是在饮食方面。说到“秋季进补”,饮用水在其中扮演了至关重要的角色,虽然大部分家庭已经把净水2024-08-15

-

尹南芯出席LV大赏 尽显典雅气质2024年8月LV秋冬女装大秀在杭州圆满落幕,此次秀场还原Nicolas Ghesquière加入路易威登10周年的巴黎大秀,也是路易威登中国今年唯一一场大型女装秀。演员尹南芯受2024-08-15

-

借IBM watsonx之力,拥抱AI为先的未来作者:国际商业机器中国香港有限公司(IBM)总经理潘凤瑶(Mimi Poon) 北京2024年8月15日 /美通社/ -- 在不久之前举行的IBM香港科技论坛上,IBM携手Compucon、Ingram Mic2024-08-15