Prices would rise, capital discipline evolve and spending increase by 30% for the upstream sector to meet demand in a delayed energy transition scenario

LONDON/HOUSTON/SINGAPORE, 16 January 2025 – As the risk of a delayed energy transition scenario increases, so does the possibility of a much greater pull on future oil & gas supply. But meeting this demand would require a significant increase in upstream investment, resulting in higher hydrocarbon prices and significant shifts in corporate strategy, according to the latest Horizons report from Wood Mackenzie.

According to the report “Taking the strain: how upstream could meet the demands of a delayed energy transition”, a variety of external pressures have weakened government and corporate resolve to spend the estimated US$3.5 trillion required to restructure energy systems to limit both hydrocarbon demand and global warming.

Wood Mackenzie’s latest Horizons report focuses on the additional resources and spend required if the upstream sector was to meet higher-for-longer oil and gas demand, and the resultant consequences.

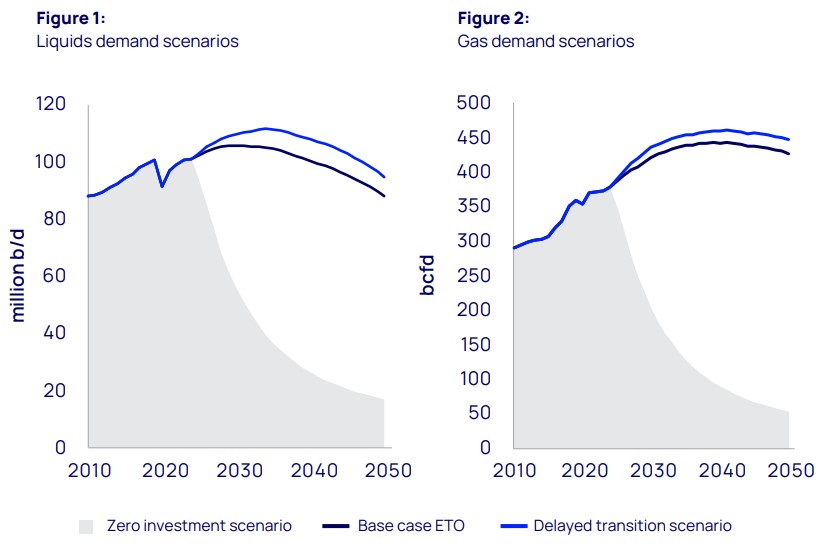

Under this scenario the world would require 5% more oil and gas supply and 30% higher annual upstream capital investment. Liquids demand would average 6 million b/d (6%) higher than Wood Mackenzie’s base case to 2050, and gas demand would average 15 bcfd (3%) higher than the base case.

“Meeting rising demand in the near term in either the delayed scenario or the base case poses little challenge to the sector; plenty of supply is available,” said Fraser McKay, head of upstream analysis for Wood Mackenzie.

“However, stronger-for-longer demand growth is a much stiffer ask. A five-year transition delay would require incremental volumes equivalent to a new US Permian basin for oil and a Haynesville Shale or Australia for gas,” said Angus Rodger, head of upstream analysis for Asia-Pacific and the Middle-East.

Source: Wood Mackenzie Energy Market Service – Global Energy Transition Outlook

Increased upstream investment needed

While we believe the global oil and gas sector could meet this demand through existing resources and future exploration, significant investment would be required to achieve it.

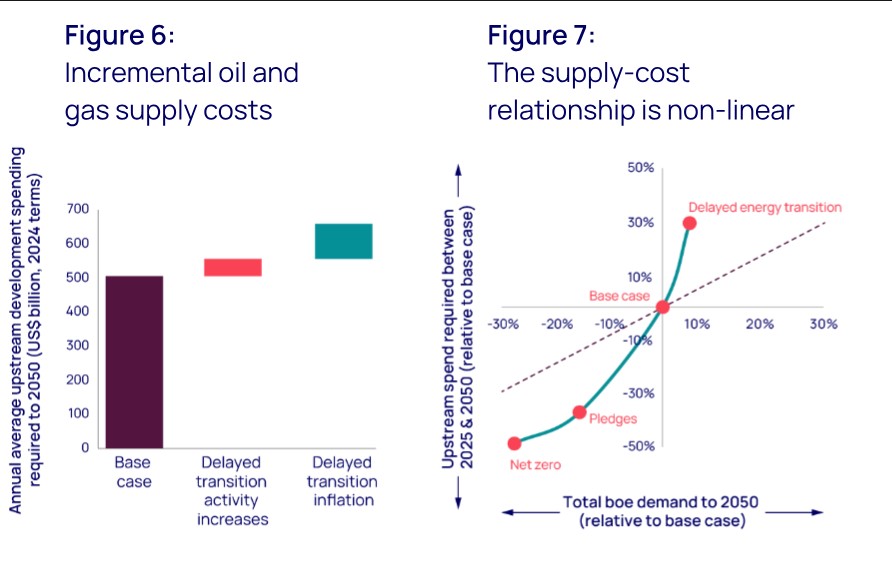

Wood Mackenzie estimates that upstream spending would have to rise by 30%, resulting in US$659 billion of annual development spend versus US$507 billion in the base case, and US$17 trillion versus US$13 trillion in total to 2050 (all in 2024 terms).

“We have calculated the sector’s cost elasticity by integrating our field-by-field annual supply models with our global supply-chain analysis,” said McKay. “This includes an assumption for continued operational efficiency improvements, which the industry could very well outperform, mitigating some of the inflationary impact.”

But increasing spend won’t be easy, even if the signs of increased demand are present. More activity would put significant pressure on the supply chain – parts of which are already running near capacity – and project costs would inflate.

“The industry’s current strict capital discipline edict would also have to change or, at least, what defines discipline would have to evolve,” said Rodger.

“Corporate planning prices would increase if the outlook for the market improved, with increased confidence in demand longevity. In that environment, higher development unit costs and breakevens would likely be tolerable,” said McKay.

Price escalation

With the higher cost of supply, so too would come higher prices for both oil and gas. Wood Mackenzie’s Oil Supply Model forecasts a Brent price rising to over US$100/bbl during the 2030s in a delayed transition scenario. It falls towards US$90/bbl by 2050, averaging around US$20/bbl higher than our base case over the period (all in 2024 terms).

Read the entire report here.

ENDS

Editors Notes:

Definition of scenarios:

Base case - Wood Mackenzie’s base case is an assessment of the most likely outcome, corresponding to 2.5 ˚C warming by 2050, incorporating the evolution of current policies and technology advancement.

Delayed transition scenario - Assumes a five-year delay to global decarbonisation efforts due to ongoing geopolitical barriers, reduced policy support for new technologies and cost headwinds.

For further information please contact Wood Mackenzie’s media relations team:

Mark Thomton

+1 630 881 6885

Mark.thomton@woodmac.com

Hla Myat Mon

+65 8533 8860

hla.myatmon@woodmac.com

The Big Partnership (UK PR agency)

woodmac@bigpartnership.co.uk

You have received this news release from Wood Mackenzie because of the details we hold about you. If the information we have is incorrect you can either provide your updated preferences by contacting our media relations team. If you do not wish to receive this type of email in the future, please reply with 'unsubscribe' in the subject header.

About Wood Mackenzie

Wood Mackenzie is the global insight business for renewables, energy and natural resources. Driven by data. Powered by people. In the middle of an energy revolution, businesses and governments need reliable and actionable insight to lead the transition to a sustainable future. That’s why we cover the entire supply chain with unparalleled breadth and depth, backed by over 50 years’ experience in natural resources. Today, our team of over 2,000 experts operate across 30 global locations, inspiring customers’ decisions through real-time analytics, consultancy, events and thought leadership. Together, we deliver the insight they need to separate risk from opportunity and make bold decisions when it matters most. For more information, visit woodmac.com.

Source: Wood Mackenzie Energy Market Service – Global Energy Transition Outlook

Increased upstream investment needed

While we believe the global oil and gas sector could meet this demand through existing resources and future exploration, significant investment would be required to achieve it.

Wood Mackenzie estimates that upstream spending would have to rise by 30%, resulting in US$659 billion of annual development spend versus US$507 billion in the base case, and US$17 trillion versus US$13 trillion in total to 2050 (all in 2024 terms).

“We have calculated the sector’s cost elasticity by integrating our field-by-field annual supply models with our global supply-chain analysis,” said McKay. “This includes an assumption for continued operational efficiency improvements, which the industry could very well outperform, mitigating some of the inflationary impact.”

But increasing spend won’t be easy, even if the signs of increased demand are present. More activity would put significant pressure on the supply chain – parts of which are already running near capacity – and project costs would inflate.

“The industry’s current strict capital discipline edict would also have to change or, at least, what defines discipline would have to evolve,” said Rodger.

“Corporate planning prices would increase if the outlook for the market improved, with increased confidence in demand longevity. In that environment, higher development unit costs and breakevens would likely be tolerable,” said McKay.

Price escalation

With the higher cost of supply, so too would come higher prices for both oil and gas. Wood Mackenzie’s Oil Supply Model forecasts a Brent price rising to over US$100/bbl during the 2030s in a delayed transition scenario. It falls towards US$90/bbl by 2050, averaging around US$20/bbl higher than our base case over the period (all in 2024 terms).

Read the entire report here.

ENDS

Editors Notes:

Definition of scenarios:

Base case - Wood Mackenzie’s base case is an assessment of the most likely outcome, corresponding to 2.5 ˚C warming by 2050, incorporating the evolution of current policies and technology advancement.

Delayed transition scenario - Assumes a five-year delay to global decarbonisation efforts due to ongoing geopolitical barriers, reduced policy support for new technologies and cost headwinds.

For further information please contact Wood Mackenzie’s media relations team:

Mark Thomton

+1 630 881 6885

Mark.thomton@woodmac.com

Hla Myat Mon

+65 8533 8860

hla.myatmon@woodmac.com

The Big Partnership (UK PR agency)

woodmac@bigpartnership.co.uk

You have received this news release from Wood Mackenzie because of the details we hold about you. If the information we have is incorrect you can either provide your updated preferences by contacting our media relations team. If you do not wish to receive this type of email in the future, please reply with 'unsubscribe' in the subject header.

About Wood Mackenzie

Wood Mackenzie is the global insight business for renewables, energy and natural resources. Driven by data. Powered by people. In the middle of an energy revolution, businesses and governments need reliable and actionable insight to lead the transition to a sustainable future. That’s why we cover the entire supply chain with unparalleled breadth and depth, backed by over 50 years’ experience in natural resources. Today, our team of over 2,000 experts operate across 30 global locations, inspiring customers’ decisions through real-time analytics, consultancy, events and thought leadership. Together, we deliver the insight they need to separate risk from opportunity and make bold decisions when it matters most. For more information, visit woodmac.com.

-

A delayed energy transition could make or break the upstream sectorPrices would rise, capital discipline evolve and spending increase by 30% for the upstream sector to meet demand in a delayed energy transition scenar2025-01-16

-

buildingSMART 国际代表赴河套深圳园区交流合作buildingSMART 国际代表赴深圳河套深港科技创新合作区交流合作数字化建设,并在产业协同创新、资源共享整合、前沿技术应用推广等方面积极交流。2025-01-16

-

泰国领先的工业园区公司安美德集团 (Amata Corp.) 庆祝成立50周年来源 AMATA2025-01-16

-

以长期主义为笔,老板电器勾勒中国厨电未来的新轮廓2024年,中国经济在复杂多变的环境中前行,家电行业也面临着持续增长的挑战。随着高速增长的发展红利期成为过去,用户需求日益复杂化,沿袭以往增长方式的企业陷入日趋激2025-01-16

-

洲际酒店集团迎来在华50周年里程碑五十功名尘与土,八百山河云和月 2025年1月16日, 上海 – 近日,洲际酒店集团迎来在华发展的50周年重要里程碑。从1975年首店的开设到如今800家酒店覆盖大中华2025-01-16